SCOTUS Today - Moore v. United States: The Tax Litmus Test Every American Should Watch

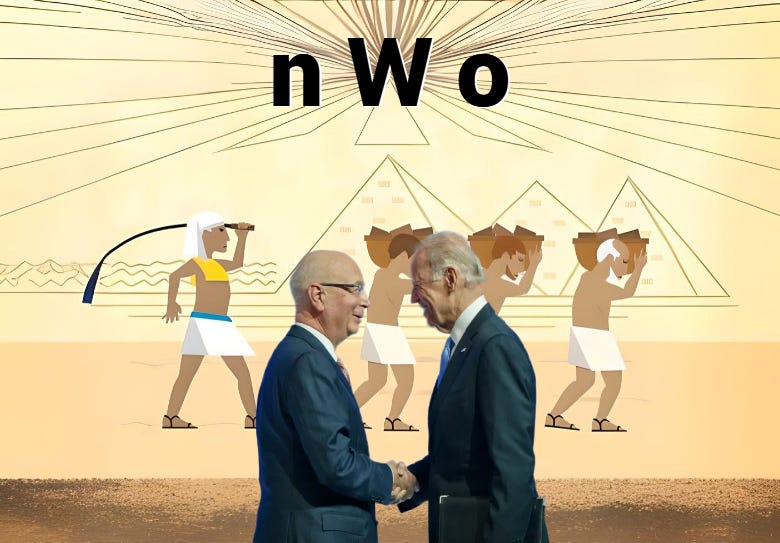

The Biden Admin's Lawyers Argue For a Davos-Inspired Tax Shift. If Adopted, Will Klaus Schwab's Prediction Come True? “You Will Own Nothing, and You Will Be Happy.”

By Richard Luthmann

Today, the U.S. Supreme Court will hear oral arguments in its most significant tax case in half a century. But you probably won’t hear much about it, and that is by design.

The High Court grapples with Moore v. United States. At its core, the question is: Can the Government tax “phantom gains” or income that hasn’t hit the taxpayer’s hands?

States like Idaho and Montana and many taxpayers’ rights organizations rally behind the Washington couple challengers, Charles and Kathleen Moore. Their fight against the U.S. Government will be defining.

Here’s the background: The Moores own a small, yet significant, eleven percent stake in KisanKraft, a farming company based in India.

The company has done well, and the Moore’s shares have grown in value. But, they haven’t sold shares or reaped rewards in the U.S. No money has hit their hands.

Still, the Government handed them a bill on this unrealized “phantom” gain.

Their stand is clear. Such taxation violates the Sixteenth Amendment and past SCOTUS decisions. They believe the Government overstepped its bounds.

The issue of whether unrealized gains can be taxed is as crucial on Main Street as it is on Wall Street. The Moore’s case serves as a litmus test, challenging the taxation rules and the limits of when and how tax may be properly imposed.

If the Government prevails, a homeowner could be handed a tax bill for estimated, unrealized, “phantom” appreciation in the value of their property by a state or municipal taxing authority in a cash-strapped state. This is even if they have lived there for years and have no plans to sell anytime soon.

If you sell your home, you pay capital gains after the sale is complete. The reason is a practical one. The sale establishes the value - what a willing buyer would pay a willing seller in ordinary market conditions.

The real estate agent has earned her commission at the closing table. She is paid on the sale value of the closed transaction. Talk to her before the deal. She could not have told you her commission nor the value of the house.

If you hired a good agent, they would have performed a market analysis and told you a range the house might sell for. They guarantee nothing. The same applies to appraisers and valuations for all things - cars, stocks, art, memorabilia, and even collections of fine wine or single malt scotch.

But it’s all educated guesswork. And that’s what the Government argues should be the basis of your tax bill. THEIR educated guesswork.

Put aside the potential for grift and abuse. Ignore Chief Justice Marshall’s famous words for a moment: “The power to tax is the power to destroy.” Focus on a fundamental question of valuation: do property prices fluctuate?

You bet they do.

The system works now because the sale price is set. It is what it is. Buy low, sell high. Sometimes, you win or lose, but the tax always follows the deal.

The system the Government wants is one attempting to assess tax bills on moving targets based on guesswork, albeit educated and expert, they claim.

Have you seen your local property assessor lately? They’re not exactly the person who turned down the big job at NASA.

How did we get here? It began with Section 965 of the Internal Revenue Code. Born from the 2017 Tax Cuts and Jobs Act, it aimed to pull back wealth from U.S. companies abroad. It sounded like a good thing, but it cast too broad of a net. The Moores got entangled due to their stake in KisanKraft.

The crux of the matter? The Government says taxation on their property without the money ever hitting their hands is entirely legitimate.

The U.S. Government argues that “realization” isn’t a constitutional necessity. You don’t actually have to have received any money or property before the Government can send you a tax bill. In so doing, they hope to fundamentally redefine what’s “taxable.”

If the Court sides with the Moores, they might merely adjust the language of a single statute, keeping most of the tax law intact. If the Government wins, Americans face not just more paperwork but also taxation on unrealized gains.

The National Taxpayers Union Foundation advocates for a middle ground. They suggest the court should keep the tax for companies but spare individuals like the Moores. They say this way, the tax’s goal remains, while the realization principle stands.

But that proposal is blatantly moronic. Any accountant or tax lawyer would quickly realize that the only thing the largest multinational corporations (or any corporations for that matter) would have to do to skirt the brunt of the law and receive the greater benefits for individuals would be to appoint qualifying nominees or fiduciaries to act in their stead.

This Supreme Court hasn’t shown an appetite for heavier taxation, let alone a desire to fundamentally change a building block concept of income tax law. They may not favor the Government’s view.

But if the Government does win, it’s getting close to time to throw in the towel. If the Government can tax money that hasn’t actually hit your hands, there are no limits to what it can regulate and what you cannot be dispossessed of.

It’s fitting that the Biden Administration’s lawyers are arguing for a new income tax scheme directly from Davos and the World Economic Forum. And if they have their way, Klaus Schwab will be right: “You will own nothing, and you will be happy.”

Keep an eye on Moore v. United States. It might be the greatest economic and cultural barometer we see from SCOTUS, not just this term but for this decade, and whether America remains on a collision course for impending decline and disaster.

This is For Real? is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Taxes on phantom gains… frightening reality.