The Troubling Case of Frank Parlato

Concealed "Mistakes" and Overreaching Prosecutors Highlight the Injustice of Federal Crimes in the Era of Weaponized Justice

Frank Parlato, the unyielding journalist, and proprietor of the Frank Report, faces his fate today, July 31, as he stands for sentencing in Buffalo Federal Court. His crime is a failure to file an IRS Form that most folks have likely never even laid eyes upon. Back in 2010, when he committed the act, Parlato was just as clueless about it as anyone else.

Still, the relentless U.S. Attorney’s Office, led by Trini Ross, has no intentions of going easy on the 67-year-old Parlato. They’ve urged Judge Richard J. Arcara to ship him off to the cold confines of federal prison for a staggering two years or more.

It’s worth noting that Parlato is no tax evader; the Government concedes that much. His felonious misstep lies in failing to submit the approved IRS paperwork – a bureaucratic maze he had no clue he had to navigate. Parlato, a man of many ventures, a businessman, journalist, and media tycoon, had a whole cadre of legal eagles, accountants, and savvy business experts on his payroll. But none of these wise folks bothered to enlighten him about this seemingly insignificant obligation.

In the business world, when you find yourself handling hefty cash receipts exceeding the mark of $10,000, there’s a duty bestowed upon you – filing the IRS Form 8300. It’s a simple report, mind you, not a tax payment. Just a record of the transactions transpiring within your enterprise. This reporting responsibility stands alongside the obligatory bank reports for transactions crossing the same threshold of $10,000. It’s a bureaucratic dance, no doubt, but one you can’t avoid.

What Happened Here?

Over the span of years, Frank Parlato took the reins as manager and CEO of the One Niagara Building, stationed in Niagara Falls, New York. With his hands at the helm, he wrought a remarkable metamorphosis upon this once-slumbering eyesore, birthing it anew as a thriving tourist hub, just a stone’s throw away from the grand attractions that draw them near. Even today, the One Niagara Building stands tall, a testament to his triumph.

A tale of enduring triumph, Parlato carved a path for average-joe vendors to bask in the spoils of tourism at One Niagara for a remarkable fifteen years and counting.

In 2010, nearly a dozen years ago, a food stand proprietor, in a bona fide transaction, forked over a sizable sum of $19,970.00 in cash for rent at One Niagara. This hard-earned money found its way into the safe embrace of a business bank account, and every penny due was dutifully handed over to settle income taxes.

And yet, the “crime” pinned on Parlato lies in a mere omission – he neglected to file the required IRS Form, a slip that sparked an unnecessary tumult.

Parlato had no hidden agenda, no sly tricks up his sleeve. Truthfully, he wasn’t even handling the rent payments at the One Niagara Building. Their approach to business was meticulous and conscientious. Back then, Parlato held the firm belief that the bank would dutifully report the cash transaction exceeding $10,000 – indeed, they did just that. His stewardship of One Niagara’s affairs was guided by honesty and genuine goodwill.

The Government’s Lie: “Parlato is Guilty Because He’s’ a Deadbeat”

The Government’s depiction of Parlato paints a grim portrait, as if he ought to be cast away, shackled, and forgotten. They claim he readily confesses to owing a staggering $400,000 in income taxes, all while holding a “dangerously flippant” attitude towards tax and legal matters and overall branding him a contemptible character.

But amidst all this, the Government’s foundation rests on a single false statement, as mentioned in their written submission to Judge Arcara. From this single thread of deception, they weave their entire tale for sentencing.

In the realm of federal courts, the U.S. Sentencing Guidelines act as guiding lights, pointing the way to appropriate sentences. The case of Bernie Madoff serves as an example; his life sentence was a consequence of the billions lost through his criminal actions.

Now, the Government aims to paint Parlato with a brush akin to a “mini-Madoff,” accusing him of causing the IRS a “tax loss” of nearly $400,000.

Yet, this claim, to put it plainly, is pure poppycock.

We’ve grown accustomed to expecting “voodoo economics” from the corridors of power in Washington, D.C. But when these same whimsical practices target small business owners, it’s a whole different matter.

How on earth can the failure to file a solitary tax reporting form, one they didn’t even know about, while the Government acknowledges all taxes were indeed paid, lead to two-year imprisonment?

What is the Government’s response? A murky evasion of a clear answer.

And that’s probably because their prosecution of Frank Parlato is something that Congress never intended. And the U.S. Supreme Court said so in the 1991 case of Cheek v. United States.

“Congress does not intend that a person, by reason of a bona fide misunderstanding as to his liability for the tax, as to his duty to make a return, or as to the adequacy of the records he maintained, should become a criminal by his mere failure to measure up to the prescribed standard of conduct.”

The Western District of New York’s U.S. Attorney’s Office and U.S. Attorney Trini Ross are wading into very muddy waters in the Parlato case.

The Truth: Parlato Actually Paid All His Taxes; Was the WDNY Indictment a Political Contact?

The Government and Parlato didn’t arrive at the Form 8300 offense on the fly. There was a detailed Plea Agreement resolving allegations in an indictment that originated in 2015 when William J. Hochul was U.S. Attorney, and controversial retired AUSA Anthony M. Bruce was the lead prosecutor.

In the original indictment, Clare Bronfman, the Seagrams’ Heiress and NXIVM felon, threw around accusations about how Parlato had supposedly “stolen” a million dollars from her.

The truth, however, is quite different. In a real act of business and real estate “magic,” Parlato managed to salvage a $26 million California property, which was on the brink of becoming a total loss due to Bronfman’s negligence. This feat paralleled his previous shrewd dealings in the One Niagara venture.

Already in Bronfman’s employ, Parlato received a monthly retainer, and when he saved the California property, she was more than happy to pay him a “success fee.” Truth be told, Bronfman got a bargain. If she had engaged a law firm for the task, an $8 million fee would not have been out of the ordinary. But then, Tony Bruce wouldn’t have had the audacity to twist those events into an FBI investigation and subsequent federal grand jury indictment.

Bronfman’s allegations, it must be said, were nothing but lies, repeatedly debunked on multiple occasions, even during the NXIVM trial. Stephen Herbits, a respected American public servant and former Secretary General of the World Jewish Congress, who served as an advisor to Edgar M. Bronfman and an executive of the Seagram Company, discredited those false claims.

The real story lies in the shadows of a political scheme. Through his investigative reporting, Parlato had ruffled feathers among New York State politicians, exposing their shady deals.

By shedding light on the questionable $100 million “gift” from former Governor Andrew Cuomo to businessman James V. Glynn, disguised as “no-bid” contracts for the Maid of the Mist, Parlato disrupted the smooth flow of business and cut into the pool of “grease” available in the form of campaign contributions.

In the early stages of Parlato’s pursuit of the Maid of the Mist tale, a scene reminiscent of a Brian DePalma film, The Untouchables, unfolded. Cuomo seemed to have dispatched a New York State Assemblyman to “pay a visit” to Parlato. There were no bags of cash exchanged like in the movies, but a tempting offer loomed in the air – a lucrative “I LOVE NY” contract for Parlato and his media outlets, all contingent on him closing his lips. However, like Kevin Costner’s character, Elliot Ness, Parlato sent this meddler packing without a second thought.

Delaware North, owned by billionaire Jeremy M. Jacobs, Sr., was another persistent target in Parlato’s publications. This company holds sway as the single most influential purchaser of politicians in the whole of New York State, towering over its peers.

With monopoly rights to concessions in Niagara Falls State Park, Delaware North raked in revenues through a “sweetheart deal” that far exceeded its payments to New York State – nearly tenfold, to be precise. Parlato’s reporting shed light on the windfall distributed in Albany, all at the taxpayers’ expense:

For the likes of Glynn and Jacobs, it was crystal clear – Frank Parlato posed a threat to their high-powered dealings. After all, these elites had cornered the market to extract every dollar of Niagara Falls tourism money out of Western New York. And they have tons of money, so of course, they did it fair and square.

And the politicians, well, they caught the message loud and clear as the flow of “grease” and “grift” in the New York State political machinery began to ebb.

An attempt to bribe Parlato had already fallen flat. Now, they sought a “trap door” to ensnare him. Could they find a prosecutor willing to take him down? Maybe one with a politician-wife, hungry for campaign contributions? Or perhaps they could gather an “enemies list” of Parlato’s adversaries and conjure up enough “witnesses” to spin a tale that might entice a grand jury?

Oh, how they wished for a seasoned prosecutor on the cusp of retirement who’d built a career going after “The Italians.”

In the latter part of 2011, Clare Bronfman sauntered into the WDNY US Attorney’s Office, finding herself face-to-face with Bill Hochul and Tony Bruce. But she hadn’t limited her visits to just that office; she had also paid a call on other prosecutors, even journeying to the New Jersey Attorney General’s Office. Her mission was clear – Frank Parlato posed an existential threat. He held damning knowledge of NXIVM’s criminal machinations, ready to lay them bare for all to see. Bronfman, like Glynn and Jacobs, yearned for Parlato’s vanishing act.

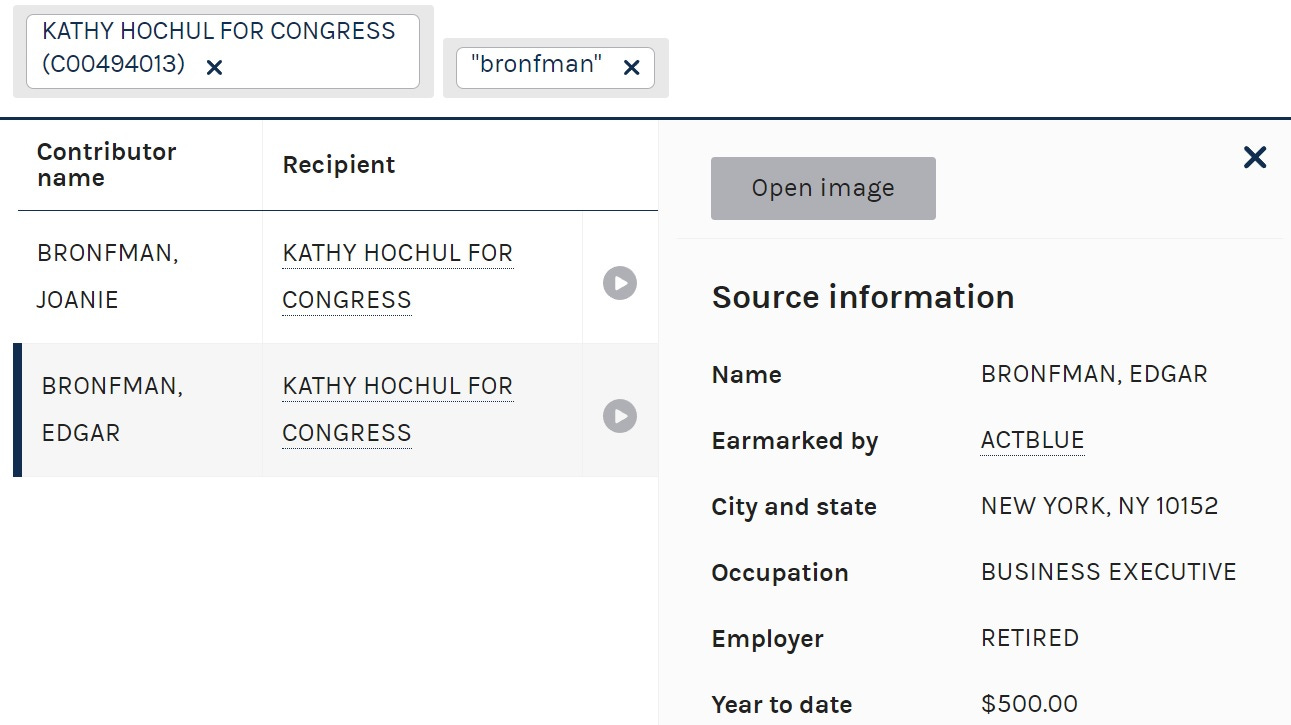

Back in 2011 and 2012, Kathy Hochul occupied a seat as Congresswoman from Buffalo. Clare Bronfman’s father chipped in as a generous contributor to Hochul’s campaign.

Back in January 2012, the FBI sat down for their first conversation with Frank Parlato. From that moment onward, Tony Bruce delved into every aspect of Parlato’s life – scrutinizing business dealings, tax returns, bank accounts, and even overdue library books – all with the aim of constructing a case to take him down.

In March 2015, Parlato warned Bruce about Clare and Sara Bronfman, labeling them as deceitful and revealing NXIVM’s criminal nature. But Bruce turned a deaf ear. The consequence? Parlato found himself indicted, and Bruce swiftly retired thereafter.

With 19 years at the WDNY US Attorney’s Office, William J. Hochul walked away in October 2016, just months shy of his pension vesting, to assume the role of General Counsel at Delaware North, a position he holds to this day.

By 2018, a new U.S. Attorney took charge of Parlato’s Superseding Indictment, conveniently erasing all references to the Bronfmans. Now, the Government asserted that they were Parlato’s “victims.”

Throughout the time since the initial indictment and the subsequent shell game the Government played with the “victims,” Parlato vehemently denied any wrongdoing.

And so, one wonders, what does the Government still seek to grasp here? Could it be related to the fact that the WDNY U.S. Attorney’s Office has been under the de facto control of the Democrat Party since 2009

A System Weaponized Against the Truth?

In the summer of 2022, Parlato geared up for a lengthy trial, facing Judge Arcara, ready to battle it out for weeks. The Government and Parlato’s lawyers, Paul Cambria and Herb Greenman, their “flat-fee” long since exhausted, engaged in their own little dance as the trial date approached.

On August 5, 2022, a paper Plea Agreement was laid out in Judge Arcara’s courtroom just before he took his seat on the bench. But Parlato refused to put pen to paper. The agreement demanded he admit to a laundry list of things he’d vehemently denied for over a decade of relentless investigation and indictment.

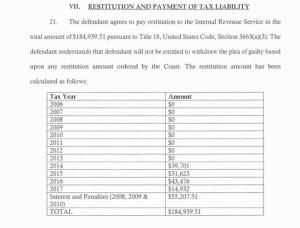

Within this deal, cooked up by the lawyers, they claimed Parlato owed a hefty sum of nearly $400,000 in taxes, with some amounts being nothing but estimates. But Parlato, standing firm, wasn’t willing to give in so easily. He had paid $260,614 in income taxes before the 2015 indictment and wanted every ounce of credit for it.

Assistant U.S. Attorney Charles Kruly, who once served as Law Clerk for Judge Richard J. Arcara, played a significant role in this legal tango. He made his mark on the agreement, scribbling substantial handwritten amendments and striking out paragraphs until Parlato finally agreed to sign.

The Government’s stance was clear – Parlato would only plead guilty to failing to file a form 8300 back in 2010. No admission of any other allegations from the original indictment, influenced by Bronfman or otherwise, or the subsequent “save-face” Superseding Indictment.

Politics may be afoot in the murky realm of the courtroom, and the US Attorney’s Office in WDNY might just be wielding its power in ways that raise eyebrows. But in the midst of it all, Parlato stood his ground, fighting for his version of the truth.

In the papers and during the Judge’s questioning, they wouldn’t dare call Parlato’s crime “intentional” or “willful,” giving rise to uncertainty. The Feds handed Judge Arcara a table displaying the taxes Parlato coughed up and the estimated amounts still due, revealing a big fat ZERO owed from 2006 to 2013.

The Government clings to a falsehood, asserting that Frank Parlato owes them nearly $400,000 in “Tax Loss.”

During proceedings before Judge Arcara, AUSA Kruly had to acknowledge that Parlato indeed made a payment, but a discrepancy remained, as the Government believed an estimated deficiency still lingered:

AUSA KRULY: The tax loss for purposes of the guidelines calculation is $390,000, but the defendant paid approximately $260,000 of that tax amount, which is why the Restitution is lower.

THE COURT: Do you understand that, sir?

THE DEFENDANT: Yes, I do, Your Honor.

However, the Government conveniently omitted a crucial detail – Parlato refrained from filing returns while under indictment (or facing imminent indictment), following the counsel of his then-lawyer, Former New York State Attorney General Dennis C. Vacco.

Parlato argues that filing taxes during this time would have waived his Fifth Amendment Right against self-incrimination.

Importantly, Parlato firmly maintains that he owes nothing to the Government. The sum of $129,732 was merely an “estimated tax deficiency.”

After he entered his plea for failing to file an obscure IRS form, Parlato promptly submitted his outstanding taxes for the years 2014-2017. Astonishingly, he owed none of the estimated $129,732.

The Government’s inflated claim resulted from the IRS basing Parlato’s income on tax years preceding the indictment – a critical miscalculation.

Why is the Government Lying About Parlato’s Taxes?

That’s a valid question. The U.S. Attorney’s Office prefers to keep its responses confined to court filings and statements made during hearings. We’ll have to wait and see what they put forth at Parlato’s sentencing, set for later today.

But it’s likely that the Government will deny any wrongdoing or dishonesty in Parlato’s case. This raises concerns about institutional problems. The stakes are high, and the very integrity of our system hangs in the balance.

In modern times, federal criminal laws have exploded in number, becoming impossibly vast and ambiguous. Prosecutors can accuse any of us of federal crimes, regardless of how innocuous our actions may seem. The sheer volume of federal crimes has surpassed the bounds of the statute books, diving deep into the murky waters of the Code of Federal Regulations. In this labyrinth, federal prosecutors discover a trove of intricate and technical prohibitions ready to be wielded against unwitting victims.

Frank Parlato’s inadvertent failure to file a Form 8300 serves as a poignant example.

This disconcerting state of affairs knows no limits. It shows no bias toward any social class or profession, jeopardizing the very core of our constitutional democracy. No one is exempt from this worrying form of overreach.

If the Government seeks to brand Frank Parlato a criminal due to taxes he has dutifully paid and tax forms he was unaware of, how long until the Department of Justice dispenses with the facade of “Justice”?

How long until we witness individuals brazenly convicted and sentenced under a justice system that clearly has no grounds for their guilt? If it hasn’t begun already.

Richard Luthmann is a writer, commentator, satirist, and investigative journalist with degrees from Columbia University and the University of Miami. Once a fixture in New York City and State politics, Luthmann is a recovering attorney who lives in Southwest Florida and a proud member of the National Writers Union.

“I am a journalist who writes about justice, the courts, government officials, prisons, and reform. You find some questionable players in all these places and often outright crooks. Exposing these bottom feeders from the outside is sometimes the only way to make them pay the price for their injustice and misdeeds.”

“I use satire and opinion to make my point. I have already been told to ‘stop writing about the Government’ by the U.S. Government, so I must be doing something right.”

“If you’re a victim of the system, maybe the press is the right forum for you. If you have experienced injustice and are tired of dropping tens of thousands of dollars without results, maybe it’s time to try the digital pen.”

Contact Richard Luthmann at 239-631-5957 or richard.luthmann@protonmail.com.

"Nihil est incertius vulgo, nihil obscurius voluntate hominum, nihil fallacius ratione tota comitiorum.” (Nothing is more unpredictable than the mob, more obscure than public opinion, and more deceptive than the whole political system.)

~ Marcus Tullius Cicero

The news media is a critical check on the powerful, serving as a watchdog to hold elected officials and other public figures accountable for their actions. The media was first called the fourth estate in 1821 by Edmund Burke, who wanted to point out the power of the press. The press plays a crucial role in providing citizens with access to information about what is happening in government and by shining a light on corruption, abuse of power, and other forms of wrongdoing.