By Richard Luthmann

In the days leading up to the shocking July 13 assassination attempt on Donald Trump at a rally in Butler, Pennsylvania, suspicious financial activity surrounding DJT stock raised red flags. Short positions against Trump Media & Technology Group ($DJT) spiked, doubling in volume just before the attack.

With the House Intelligence Committee calling for the FBI to reopen its investigation into whether Iran played a role in the attempt, the question of foreign interference looms large.

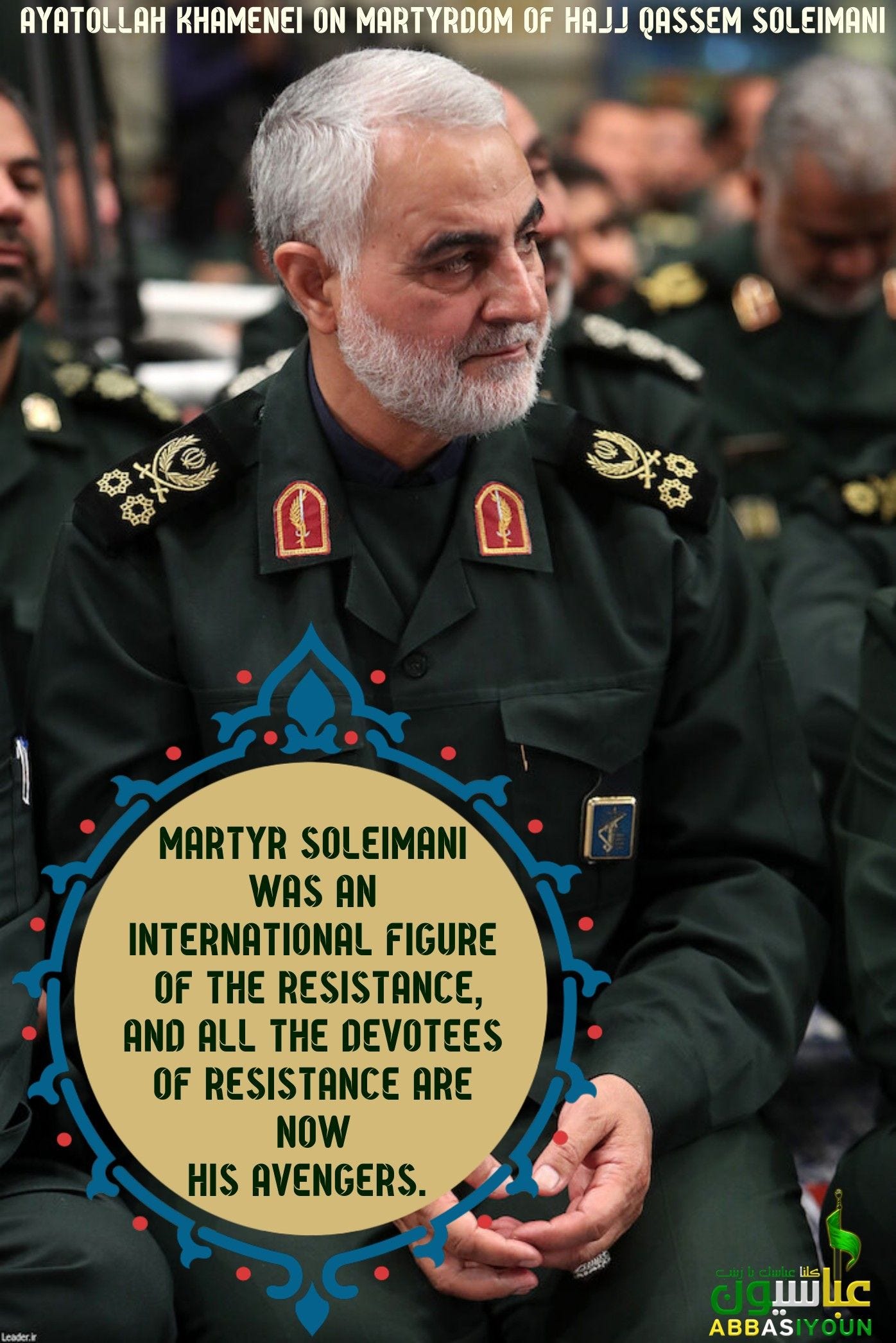

Iran’s longstanding vendetta against Trump, stemming from the 2020 killing of General Qasem Soleimani, adds weight to the theory that Tehran could be behind the plot—not only through violence but also through a sophisticated financial assault on Trump’s media company.

Explosive Allegations Emerge After Stock Shorting Frenzy

Speculation is mounting over the potential involvement of Iran in the assassination attempt on Donald Trump in Butler, Pennsylvania, after a surge of short positions on DJT stock just before the attack. Wall Street insiders are raising alarms over sovereign-backed shorting reminiscent of schemes dating back to the 2008 financial crisis.

“I was in rooms with top Wall Street players and federal law enforcement after the 2008 crash, discussing how to stop sovereign-backed shorts,” said John Tabacco, a Wall Street insider. “The pattern of trading before the Butler assassination attempt looks eerily similar.”

The question now is whether Iran, fronted by other states like Qatar or the UAE, were behind the bets on Trump’s downfall. China was linked to 2008 shorts against America’s financial sector according to financial insiders with knowledge.

House Intelligence Committee Reopens Probe

Following the assassination attempt, the House Intelligence Committee, led by Chairman Mike Turner, has reignited interest in investigating whether the attack was linked to Iranian operatives. Turner stated that “no substantiated ties” have been found linking the Butler shooter directly to Iran, but noted that the FBI’s investigations are ongoing.

“This administration must send a strong message to Iran: plotting to kill a former president is an act of war,” Turner added, referencing intelligence that Iran has made recent moves to eliminate Trump in retaliation for the 2020 assassination of General Qasem Soleimani. Iran has consistently vowed revenge for Soleimani’s death, and Trump’s role in the strike has made him a prime target for Iranian retaliation.

Sovereign-Backed Shorting—A Red Flag

In the days leading up to the Butler shooting, suspicious trading activity centered around DJT (Trump Media) stock. Short positions doubled, surging from 7 to 15 million shares between July 1 and July 12, just days before the assassination attempt. This level of shorting, unprecedented since the stock’s debut, sent shockwaves through the market.

Fintel data, however, showed no clear spike in short volume immediately before the assassination attempt, raising further questions about whether entities were masking their trades through third-party brokers.

“This kind of trading activity mirrors what we saw in 9/11,” said one analyst. “Significant bets were placed against airlines right before the attacks.”

Iran’s Motive—And Opportunity

Iran’s motivation for seeing Trump dead has been crystal clear since the killing of General Soleimani.

Another would-be assassin, Ryan Wesley Routh, was apprehended at Trump’s Florida golf course. Court documents revealed Routh had written about how Iran should assassinate Trump in retaliation for the 2018 nuclear deal withdrawal.

The complexity of the Butler assassination attempt, combined with Iran’s ongoing threats against Trump and other former administration officials, has led to renewed fears that Iran may be financing or coordinating such operations through proxies.

A Financial and Political Storm

Austin Private Wealth, a Texas-based asset management firm, came under scrutiny for shorting 12 million shares of DJT just before the Butler attack. The firm later claimed it was a clerical error. They said the short volume on DJT stock did not increase substantially before July 13. This SEC filing was filed on July 12th, but it involved investments for the period ending June 30th.

Some investors aren't buying it.

“The timing is too perfect,” said one market watcher. “Iran has every reason to see Trump removed from the equation, and the financial moves surrounding his stock don’t seem like a coincidence.”

Amid this renewed interest, experts warn of the potential for political manipulation through financial markets, with sovereign-backed trades designed to destabilize U.S. elections and leadership.

For now, all eyes are on the House Intelligence Committee as they push for the FBI to deliver a definitive conclusion on whether Iran was behind these actions.

Share this post