SCOTUS Upholds Tax on Unrealized Gains in Landmark Case

Moore v. U.S. Ruling Opens Floodgates for Taxation of 'Phantom Gains'

By Richard Luthmann

Last year, I wrote these words about what I thought was THE SCOTUS case to watch this term:

Keep an eye on Moore v. United States. It might be the greatest economic and cultural barometer we see from SCOTUS, not just this term but for this decade, and whether America remains on a collision course for impending decline and disaster.

The Supreme Court ruled Thursday in favor of a tax on "unrealized" income from overseas investments, marking its most significant tax case in half a century. The decision in the Moore case permits the government to tax “phantom gains” - income that has not actually been received by taxpayers.

SCOTUS Today - Moore v. United States: The Tax Litmus Test Every American Should Watch

By Richard Luthmann Today, the U.S. Supreme Court will hear oral arguments in its most significant tax case in half a century. But you probably won’t hear much about it, and that is by design. The High Court grapples with Moore v. United States. At its core, the question is: Can the Government tax “phantom gains” or income that hasn’t hit the taxpayer’s h…

In a 7-2 decision, the court upheld the Mandatory Repatriation Tax (MRT), a provision of the 2017 Tax Cuts and Jobs Act. The MRT, also known as the Section 965 transition tax, was enacted by a Republican-controlled Congress and signed into law by President Donald Trump.

Justice Brett Kavanaugh wrote the majority opinion, stating the tax does not violate the 16th Amendment to the U.S. Constitution. Libertarian Justice Neil Gorsuch and Original Constitutionalist Justice Clarence Thomas dissented from the majority opinion.

The ruling came after Charles and Kathleen Moore, a married couple from Washington state, argued that the tax violated the Constitution’s requirement that direct federal taxes must be apportioned among the states. The Moores also claimed the tax was an unconstitutional retroactive tax.

The Moores own an eleven percent stake in KisanKraft, an Indian farming company. Despite the company’s success and the increase in the value of their shares, the Moores have not sold any shares or received any income in the U.S. However, the government billed them for the unrealized "phantom" gain.

The Moores lost in U.S. district court, appealed, and lost again. The Ninth Circuit Court of Appeals affirmed the district court's dismissal of the case, and a divided Ninth Circuit denied the couple’s petition for a rehearing on Nov. 22, 2022.

"There is no constitutional prohibition against Congress attributing a corporation’s income pro-rata to its shareholder," the appeals court ruled.

The Supreme Court’s decision has broad implications for tax policy. If the government can tax income that hasn’t been received, it opens the door to taxing estimated gains on various types of property. This includes potentially taxing homeowners on the unrealized appreciation of their property.

This issue is as critical on Main Street as it is on Wall Street. The Moore’s case serves as a litmus test, challenging taxation rules and the limits of when and how tax may be imposed. Now, using this decision as a basis, a homeowner could be handed a tax bill for the estimated, unrealized appreciation in their property’s value by a state or municipal taxing authority.

Typically, capital gains tax is paid after the sale of an asset, when its value is determined by the market. The system works because the sale price is set, and taxes follow the deal. The government’s new approach, however, attempts to assess tax bills based on estimates.

The controversy stems from Section 965 of the Internal Revenue Code, part of the 2017 Tax Cuts and Jobs Act. The MRT aimed to pull back wealth from U.S. companies abroad, but it cast a wide net, entangling the Moores due to their stake in KisanKraft.

The U.S. Government argued that “realization” isn’t a constitutional necessity. Taxpayers don’t need to receive money or property before the government can tax them. The government’s position fundamentally redefines what’s taxable.

The 16th Amendment, ratified in 1913, allows Congress to tax incomes "from whatever source derived," without apportionment among the states.

Wealth tax proposals have been regularly floated in Congress. In March, Sen. Elizabeth Warren and House Democrats reintroduced the Ultra-Millionaire Tax Act, which would tax households with wealth over $50 million. In November 2023, Sen. Ron Wyden proposed taxing the unrealized capital gains of high earners.

Before the 2017 law, foreign income of U.S. corporations wasn’t taxed until it returned to the U.S. The MRT imposed a one-time tax on outstanding unrepatriated foreign earnings. The law taxes U.S. corporate earnings abroad going back 30 years, even if the earnings haven’t been distributed. The Congressional Budget Office estimated the law would lead to a one-time tax liability of $347 billion.

The Moores had owned shares in KisanKraft for over a decade but never received any income because the company reinvested its profits. However, the MRT resulted in a $14,729 tax bill for the Moores despite never receiving payments from KisanKraft.

The Competitive Enterprise Institute, representing the Moores, argues that the MRT taxes funds as income by simply declaring them taxable, which they claim is a legal fiction.

The Supreme Court’s ruling in favor of the MRT sets a precedent for taxing unrealized gains, potentially impacting future tax policies and taxpayers’ financial planning.

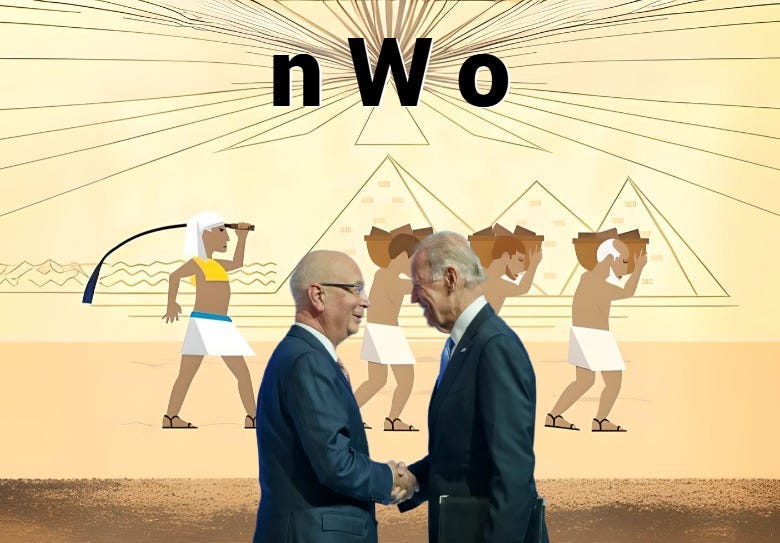

It’s fitting that the Biden Administration had SCOTUS bless a new income tax scheme directly from Davos and the World Economic Forum. They proved Klaus Schwab right: “You will own nothing, and you will be happy.”