Trump’s Winning Oil Gambit Has Putin Over a Barrel

Cheap crude becomes Russia’s worst nightmare

NOTE: This is what real leverage looks like. Not speeches. Not hashtags. Not sanctions that sound tough but leak cash. Trump understands something the foreign-policy class never has: wars are funded, not fought, by economics. Putin’s entire imperial project runs on oil revenue, and Trump is squeezing it at the source. Flood the market, crash the price, and suddenly the strongman is begging buyers and burning reserves. That’s not chaos — it’s strategy. Reagan did it to the Soviets. Trump is doing it again, cleaner and faster. No troops. No body bags. Just pressure. Putin isn’t losing on the battlefield yet — he’s losing in the ledger. This piece is Trump’s Winning Oil Gambit, first appearing on FLGulfNews.com.

By Richard Luthmann

Donald Trump just proved that black gold can win a cold war without firing a shot. In one audacious move, he’s pried open Venezuela’s oil spigot to flood the market and sucker-punch Vladimir Putin’s war chest. It’s a masterstroke in economic warfare, the kind of bold energy chess move that makes the foreign-policy “experts” choke on their lattes.

Oil is power, and Trump’s using it to bleed Moscow dry while keeping American gas prices low. Call it geo-strategic jiu-jitsu: harnessing a socialist petro-state’s crude to torpedo a communist strongman’s bankroll.

In the global chessboard of oil, Trump is thinking three moves ahead – and Putin’s about to get checkmated.

Trump’s Winning Oil Gambit: The New Cold War Weapon

This isn’t the first time oil has been weaponized to bring a tyrant to his knees. Flash back to the 1980s: Ronald Reagan and the Saudis quietly conspired to open the spigots and crash oil prices – a body blow that cost the Soviet Union $20 billion a year and sped up its collapse.

Fast forward to today’s new cold war. Putin’s Russia funds its aggression with petrodollars, making oil the central economic weapon of our era. Cheap oil is Putin’s kryptonite. Oil and gas revenue has been the Kremlin’s piggy bank, fueling military expansion and imperial dreams.

But that piggy bank is cracking: December’s Russian oil and gas revenues plummeted by almost 50% year-on-year thanks to sliding crude prices. For Moscow, this is an existential threat – oil and gas have recently made up about a quarter of Putin’s budget (down from nearly half before the war), and those funds are being drained fast by his Ukraine invasion.

Western sanctions are tightening the noose, from G7 price caps to embargoes, forcing Russia to sell its lifeblood oil at steep discounts in far-flung markets. Ukraine’s allies know that starving the Kremlin’s cash flow is key to ending the war, and Trump’s savvy oil gambit pours salt in that wound.

Trump’s Winning Oil Gambit: Venezuela’s Crude

Enter Venezuela – a former oil titan sitting on an ocean of crude. In a twist nobody saw coming, Trump has flipped the script by tapping Venezuelan oil to crash the global price party. It’s a move as bombastic as it is brilliant.

Why Venezuela?

Because it has what the world needs: heavy crude in abundance and the capacity (with help) to pump a lot more of it. Never mind that the country’s socialist regime drove its oil industry into the ground; Trump is betting that under new management, Caracas’s loss can be the free world’s gain.

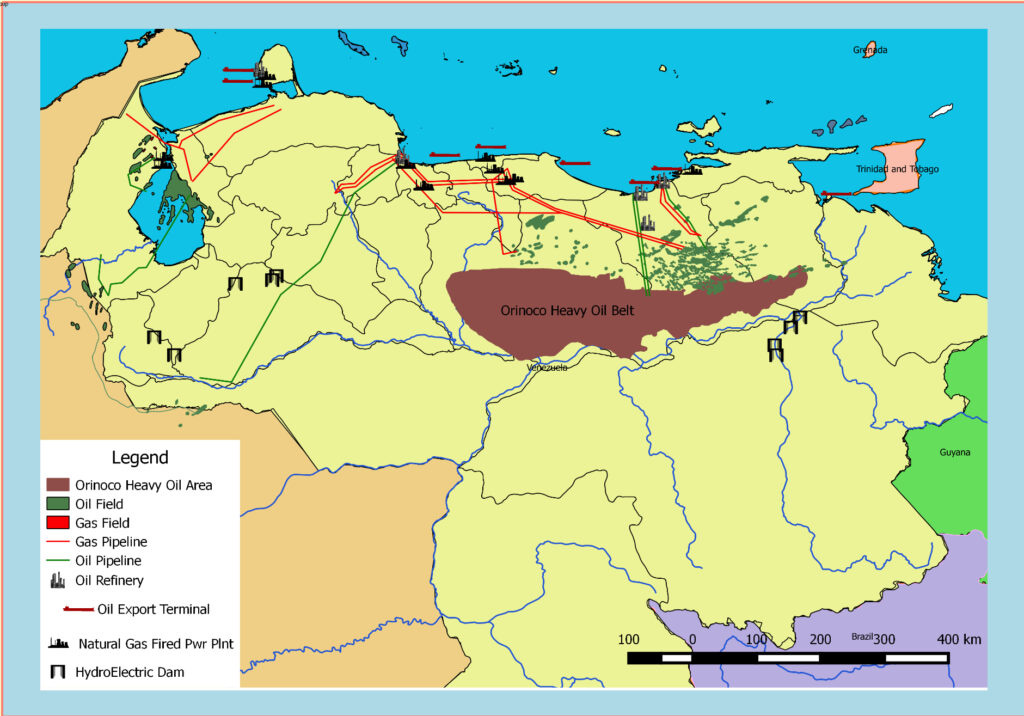

The raw numbers are eye-opening – Venezuela holds the world’s largest oil reserves (about 303 billion barrels, roughly 17% of the globe), even more than Saudi Arabia. For years, that bonanza has been locked behind mismanagement and sanctions. Production has collapsed from its glory days: the country pumped 3.5 million barrels a day in the 1970s (over 7% of world supply), but thanks to corruption, nationalization, and incompetence, output fell to under 2 million in the 2010s and barely averages 1.1 million barrels per day now– a measly 1% of global production.

In short, Venezuela is a rusting oil giant, operating at a tiny fraction of its capacity.

Venezuelan state oil company PDVSA’s logo emblazoned on a fuel tanker in Caracas (May 2025). Despite holding the world’s largest crude reserves, Venezuela’s oil output has withered to barely 1.1 million barrels per day due to decades of mismanagement. President Trump’s strategy aims to revive this dormant oil giant – not to enrich Caracas, but to unleash a wave of cheap crude that will slam Russia’s revenue and relieve global prices. (Source: Reuters/Asharq Al-Awsat)

Trump’s gambit was set in motion with a high-stakes power play: the ouster of Nicolás Maduro. U.S. forces nabbed the Venezuelan strongman – a move with echoes of Panama in 1989 – and crucially, did so without wrecking Venezuela’s oil infrastructure. This wasn’t some impulsive adventure; it was calculated. Trump made sure Venezuela’s wells, pipelines, and refineries were left intact, signaling that Venezuelan oil is open for business under new leadership.

Trump had earlier blockaded Venezuelan oil shipments to squeeze the Maduro regime, halving Caracas’s exports in the lead-up to the operation.

Now, with the regime change effectively in place, the U.S. has issued the green light to American oil majors to revive Venezuela’s decimated oilfields. Trump told Fox News that the U.S. will be “very strongly involved” in Venezuela’s oil sector, sending in Chevron and company to jump-start production.

Yes, Venezuela’s industry is in shambles and won’t pump 3 million barrels overnight; even optimistic experts say it could take 5–7 years of heavy investment to fully revive output. But markets aren’t waiting for actual barrels to flow – the mere prospect of Venezuela’s return is already driving oil prices down, fast.

It’s Economics 101: anticipation of future supply can crush prices today. Every extra barrel Venezuela can ship is one less barrel Russia can sell at a profit.

Cheap Oil Squeezes the Kremlin

Nothing terrifies Vladimir Putin more than cheap oil. Moscow’s military might is bankrolled by petroleum, and Trump is hell-bent on undercutting that lifeline. Russia’s budget is feeling the pain: by the Kremlin’s own admission, the era of fat oil profits is over, with oil/gas revenues expected to shrink to just 23% of the budget in 2026 (down from over 50% before the war).

Putin’s war machine is being forced to scrounge under the couch cushions as oil income nosedives. In fact, Russia’s oil and gas takings were so anemic this winter that the government faced a 1.6 trillion ruble deficit in a single month, compelled to plug holes with bonds and dip into its sovereign wealth fund.

That’s the power of falling oil: it’s punching gaping holes in Putin’s finances. Western sanctions and the G7’s $60 price cap have already pushed Russian crude (Urals blend) into bargain-basement territory – trading around $50 a barrel, sold in murky “shadow fleet” ship-to-ship transfers to willing buyers in Asia.

But even India and China, whom Putin desperately relies on to buy his sanctioned oil, are driving a hard bargain. They know he’s over a barrel (literally) and are demanding steep discounts of 50% or more off market prices. It’s a buyer’s market for Russian crude, and Putin is getting fleeced.

Now, Trump’s Venezuelan oil offensive threatens to blow up Russia’s last oil lifelines. With more non-Russian crude available, big importers have options – and they can tell Moscow “Nyet, unless you drop the price.” If Venezuela’s heavy crude flows again, Russia’s top customers like India can replace some Urals with Venezuela’s Merey blend. Moscow will be forced to slash prices even further to compete.

In effect, Trump is creating a buyers’ cartel by flooding the zone with alternative oil so that no one needs Putin’s crude. This is economic warfare at its finest: using the oil market glut to starve a war machine. Every dollar that oil prices drop is a dollar less for Putin’s bombs and bullets.

Already, analysts note Russia was essentially selling oil at break-even or even a loss just to keep it moving. Urals crude recently plunged so low (briefly in the $40s) that Russia was scraping by with minimal profit – a far cry from the $70+ they enjoyed before the Ukraine invasion.

If oil stays cheap, Putin faces brutal choices: cut war spending, bleed his reserves, or watch his economy crumple. We’re seeing the pressure build: the ruble has been volatile, Russia’s industrial output is sliding, and even official forecasts admit that growth has stalled. Low oil prices are a one-two punch: they gut Putin’s war budget and erode domestic confidence as welfare spending gets squeezed.

This is how empires fall – not with a bang, but a bankruptcy.

Trump’s Winning Oil Gambit: The Hidden Ace

Some might ask, why Venezuelan oil specifically? Because not all oil is created equal, and Venezuela’s heavy crude is the perfect strategic complement to hammer Russia.

Russian Urals is a medium sour crude; Venezuela’s main export grades (like Merey) are heavy sour. Many refineries, especially on the U.S. Gulf Coast and in Asia, require heavier crudes to produce diesel, jet fuel, and other products efficiently. When Venezuela was sanctioned and collapsed, Russia happily filled part of that heavy-oil gap.

Now, Trump is flipping the script again. Venezuelan heavy crude is the hidden ace up America’s sleeve – it can slot right into the supply chains that have been relying on Russian oil. U.S. refineries, for instance, were built to process heavy crude from Venezuela and other sources; they’ve been hungry for it since sanctions cut off Caracas in 2019. The return of Venezuelan barrels would be a godsend for Gulf Coast refiners, allowing them to run at full tilt.

In fact, Venezuelan tar-like crude pairs beautifully with America’s light shale oil in refinery blends, enabling the U.S. to produce more gasoline and diesel at lower cost by blending the two. Translation: cheaper gas for Americans at the pump, even as we stick it to Putin.

Trump, the businessman, understands that increasing supply = lower prices. By unlocking Venezuela, he simultaneously stabilizes U.S. energy prices and undercuts Russia’s export leverage. It’s a win-win, unless you’re sitting in the Kremlin.

There’s also a knock-on effect: OPEC’s worst nightmare. The mere whisper of Venezuelan oil returning to the market has Saudi Arabia and its OPEC+ partners sweating bullets. They’ve worked hard to prop up oil above $80 with production cuts, but Trump’s move threatens to unravel that.

Reports already suggest that Riyadh and Moscow are scheming to deepen output cuts to defend a $60-per-barrel floor – essentially an admission of how game-changing Venezuela’s return could be.

Think about that: the oil cartel is so scared of Trump’s crude offensive that they’re scrambling to prevent a price collapse. If OPEC+ cuts more, sure, they might slow the price drop, but they also cede market share – potentially to U.S. companies entering the Venezuelan market.

Trump has put them in a bind: either keep prices artificially high (letting him blame OPEC for gouging consumers), or keep output up and watch prices plunge (gutting Putin’s wallet).

It’s a delicious dilemma, served courtesy of The Donald.

The West’s Patience, Putin’s Predicament

By wielding oil as an economic weapon, Trump is not only squeezing Russia – he’s buying time and goodwill for the West in the Ukraine fight. High fuel costs and inflation have been the Achilles’ heel of Western unity. Every time oil prices spiked, you could hear Europeans and Americans grumble about the cost of supporting Ukraine. Populists and peaceniks alike pointed to pain at the pump as a reason to cut Kyiv loose.

Cheap oil changes that calculus. When gas prices are low and heating bills manageable, Western voters have far fewer reasons to complain. Putin banked on “General Winter” and an energy crisis to fracture NATO unity.

Instead, thanks in part to strategic petroleum releases and now Trump’s oil surge, energy prices have moderated. Europe had a mild winter, filled its gas reserves, and Brent crude is well off its highs.

With Venezuelan oil in play, there’s a real chance of an oil glut – and that means cheaper gasoline, cheaper diesel, lower inflation across the board. The West’s economies get a boost just as Russia’s nosedives.

Politically, this extends the West’s patience to support Ukraine; leaders can send aid and arms to Kyiv without fearing a voter backlash over $5 gas. In essence, Trump’s oil strategy strengthens the resolve of Ukraine’s backers by removing one of Putin’s leverage points: energy blackmail.

Meanwhile, what options does Putin have left? With coffers running low, he can’t bribe the Russian public forever to tolerate body bags coming home. He’s already resorting to selling gold reserves, cutting infrastructure spending, and begging clients like China for better terms. There’s even talk of Russia having to shut in some oil wells if they can’t find enough buyers – a disastrous long-term blow to their oilfields.

Putin can saber-rattle and posture, but he can’t print money out of thin air; he needs petrodollars, and Trump is slamming that door. The longer oil prices stay suppressed, the narrower Putin’s path: he might escalate militarily in desperation (raising the risk of direct confrontation) or finally come to the negotiation table once his war chest is bone-dry. Either way, he’s on the back foot.

Trump’s Winning Oil Gambit: Checkmate on the Global Chessboard

Trump’s Venezuelan oil gambit is nothing short of strategic genius. In trademark style, he’s turned a Latin American fiasco into a geopolitical ace card. By weaponizing cheap oil, Trump is doing what sanctimonious summits and toothless U.N. resolutions never could: cutting off the blood supply of Putin’s war machine.

It’s bold, it’s confrontational, and it’s brilliantly effective.

Oil has once again become the decisive piece on the global chessboard, and Trump just flipped the board on Moscow.

The result?

Putin’s economy is running on fumes, his options shrinking by the day, while the West enjoys cheaper gas and newfound stamina to stand with Ukraine.

In this high-stakes game of petroleum poker, Trump is all in –, and he’s got the winning hand. The verdict is clear: cheap oil trumps Russian aggression, and Donald J. Trump is savvy enough to play that card to the hilt.

Putin can rant and rave, but he can’t fund his war on empty coffers.

Checkmate, Vladimir – you’re over a barrel now.

Nice article, Richard, a good read. Let me preface by saying I am a loyal Trump supporter and have been since he announced in 2015.

Let me start with this where you write: harnessing a socialist petro-state’s crude to torpedo a communist strongman’s bankroll.

If Putin was a communist strong man, it would stand to reason that he would be running a communist nation which he is not. Communism ended in Russia in 1991 when the Soviet Union collapsed. The nation has adopted a market economy with private ownership of the means of production, a hallmark of capitalism. and I also don’t believe that Russia is on the verge of collapse, and I don’t believe that cheap oil is going to affect Russia economy to a great extent. The Russian ruble has significantly outperformed the US dollar in 2025, rising 45% against it since January, making it the world’s best-performing major currency.