LUTHMANN NOTE: This is how they always do it. When you can’t beat the facts, you attack the messenger. David Weigel didn’t steal from clients. He didn’t lie. He didn’t underperform. He embarrassed powerful people by exposing a rigged family court system that profits from broken families and traumatized children. So the lawyers reached for the only weapon they had left: his license. That’s not consumer protection. That’s retaliation. The CFP Board can either stand for fiduciary integrity and free speech, or it can go down as another captured institution doing dirty work for worse actors. Silence is not neutrality. Silence is complicity. This piece is Wall Street Warrior Declares War on CFP Board, first available on TheFamilyCourtCircus.com.

By Rick LaRivière and Richard Luthmann

Whistleblower Unleashes Fury on CFP Board

Wall Street has a new kind of warrior, and he’s coming out swinging. David Weigel – one of the world’s top 1% fixed-income money managers – has declared all-out war on the Certified Financial Planner Board.

In a blistering broadside more street-fighter than suit-and-tie, Weigel is accusing the CFP Board of targeting his professional credentials in retaliation for his crusade against corruption. He’s not mincing words about the Board’s attorneys, either.

Weigel blasted his “fake ass regulators who’ve been busting my balls” with one too many inquiries. Instead of bowing, he’s daring them to face him in the light.

“I am not refusing to cooperate. I am requiring total public involvement in the process,” he wrote defiantly to CFP Board counsel Andrew Friedman and investigator Sam Shiffman.

This top-ranked portfolio manager is also a whistleblower raising hell beyond Wall Street – and he says that’s precisely why the CFP Board is coming after him now.

David Weigel, founder and “general” of the Family Court Fraud Warrior Project, has become Public Enemy #1 of the family court establishment.

“When you got Mr. Friedman involved, it became 100% clear that I was under attack by the number one tactic to silence whistleblowers in this country – used time and again to attack one’s professional licenses,” Weigel said, calling the CFP Board inquiry a blatant attempt to muzzle him.

He’s taking the fight public with bombastic flair. In a recent video message, Weigel addressed the Board’s lawyers directly, announcing he’s had enough and won’t play their quiet back-room game.

“They finally hit me with one too many inquiries, and I’ve had enough,” he said, vowing to make his response “very, very public.”

His response? An unfiltered, unyielding barrage of truth-to-power.

“I need you both to go f* yourselves immediately,”** the Wall Street warrior tells his CFP Board inquisitors – a quote that landed like a bombshell and set the tone for an unprecedented showdown.

Top 1% Performance, Targeted for ‘Doing Too Good’

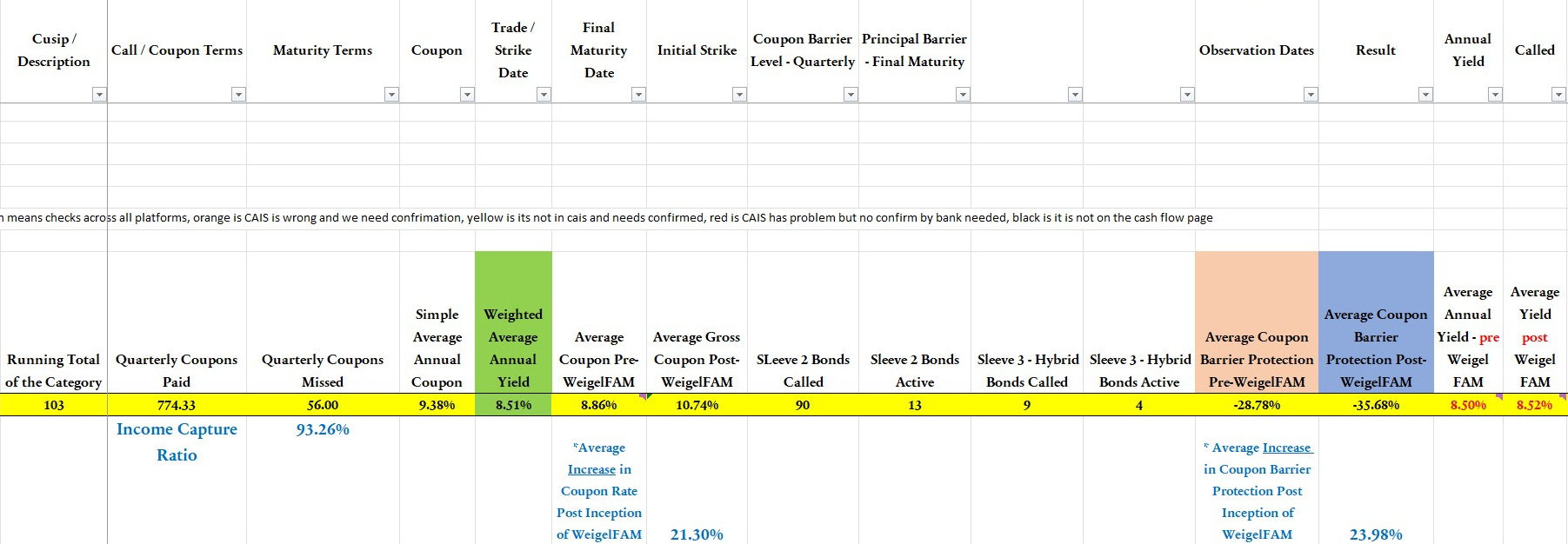

Weigel isn’t just another financial advisor – he’s a globally top-ranked fiduciary with a track record few can touch. Over the past decade, his flagship fixed-income strategy posted returns in the Top 1% worldwide, outperforming thousands of peers.

In fact, out of 2,626 tracked fixed-income managers across 22 global categories, Weigel’s results beat them all – placing him literally at #1 in the world for long-term performance. That’s not hype; independent analyses confirm his strategy’s returns rank in the top 0.04%, the absolute pinnacle of performance.

This is a man who delivers results that most Wall Streeters only dream of. And he’s done it while upholding a standard of ethics that, by all accounts, is unimpeachable. Regulators have already combed through his books again and again – six back-to-back SEC audits – and found nothing amiss.

“Yes, I am that good, and I’m that honest,” Weigel says, exuding the confidence of a professional at the peak of his powers.

By any measure, David Weigel is the fiduciary you’d expect a professional board to hold up as a model – not haul into an investigation.

That’s exactly why he and his supporters are calling the CFP Board’s probe absurd. Weigel wears the label “the definition of a fiduciary” as a badge of honor. He’s spent nearly 13 years proving it through unmatched client returns and rigorous compliance.

The irony of being scrutinized by a financial ethics board isn’t lost on him. It infuriates him. To Weigel, the CFP Board action isn’t about any actual wrongdoing on his part – it’s punishment for his principles.

“Your buddies from the Bar Association have clearly put a hit on me,” he wrote, suggesting the Board’s lawyers are taking orders from an outside clique bent on revenge.

In his eyes, this “investigation” is nothing more than a witch hunt triggered by his success and outspokenness. Weigel even taunts that he’s not afraid to lose his CFP designation if it comes to that. He has plenty of other letters after his name, and he’s not about to betray his values to keep a credential.

If the CFP Board thought a threat to his title would intimidate him, they guessed wrong. As he bluntly put it, “I’ve always been the definition of a fiduciary… Now I’m happy to remove a couple of letters after my name – I got plenty to spare.”

In other words: integrity over credentials, every time.

Wall Street Warrior Declares War: Questions For the CFP Board

Andrew Friedman and Sam Shiffman are not household names, but in the David Weigel case, they have become central figures. Both function as enforcement lawyers for the CFP Board, operating largely out of public view while wielding enormous power over a professional’s livelihood.

They are not elected. They are not judges. Yet their decisions can end careers. In Weigel’s case, they stepped in after his advocacy against family court corruption went viral and began naming names.

We reached out to Friedman and Shiffman to find out why. As of press time, they did not respond. Here is what we asked:

From: Rick LaRivière <RickLaRiviere@proton.me>

Date: On Friday, January 16th, 2026 at 8:37 AM

Subject: Press inquiry: Why is the CFP Board targeting David Weigel?

To: sshiffman@cfpboard.org <sshiffman@cfpboard.org>, afriedman@cfpboard.org <afriedman@cfpboard.org>

CC: Michael Volpe <mvolpe998@gmail.com>, Richard Luthmann <richard.luthmann@protonmail.com>, Modern Thomas Nast <mthomasnast@protonmail.com>, Frankie Pressman <frankiepressman@protonmail.com>, RALafontaine@protonmail.com <ralafontaine@protonmail.com>Gentlemen,

This is a journalistic request for comment regarding CFP Board Matter No. 2024-66017 involving David W. Weigel, CFP®. We expect to go to press shortly and would like on-the-record responses to provide readers with a fair and balanced view of the issues. If we publish before you respond, we will incorporate your feedback into a follow-up.

1.Who initiated the CFP Board’s investigation of David Weigel — a client, the Board itself, or a third-party “tip”?

2. Did any family court judges, family court attorneys, bar associations, or court-appointed professionals communicate with CFP Board about Weigel before or during this matter?

3. Are you investigating Weigel for client harm, or for his public speech and advocacy against family court corruption?

4. Is CFP Board disciplining Weigel because his activism makes lawyers or judges uncomfortable?

5. Do you deny that attacking professional licenses is a common tactic used to silence whistleblowers?

6. Given Weigel’s top-1% global fixed-income performance and lack of client complaints, what public interest is served by this inquiry?

7. Does the CFP Board endorse, tolerate, or enable “designer child trafficking” — the monetization of children through custody litigation and court-linked fee systems? Please answer yes or no.

8. If not, will the CFP Board state clearly that it opposes any family-court practices that financially incentivize separating children from fit parents?

9. Finally, who do you work for — the public, or the legal institutions now under scrutiny by Weigel and the Family Court Fraud Warrior Project?Again, we intend to go to press shortly. We appreciate your time and courtesy.

Thanks,

Rick LaRivière

Independent Journalist

(239) 766-5800

Follow Me On Substack

To critics, Friedman and Shiffman represent a familiar pattern in modern regulation: attorneys and investigators who claim neutrality while advancing opaque complaints, declining to identify accusers, and applying pressure through process rather than proof.

Their involvement raises uncomfortable questions about regulatory capture, outside influence, and whether the CFP Board’s enforcement arm is being used to police financial misconduct—or to punish dissent that threatens powerful legal interests.

Retaliation for Exposing a Crooked Empire: Wall Street Warrior Declares War

So why would a body tasked with upholding financial ethics come after one of the most ethical, high-performing advisors alive? Weigel has a simple answer: retaliation. In addition to managing money, he’s been raising hell in an entirely different arena – America’s family courts.

Weigel founded the Family Court Fraud Warrior Project, a grassroots crusade uniting parents and victims to expose rampant corruption in family law. In under a year, over 18,000 people – mothers, fathers, children – have rallied to his cause. They’re shining a light on a system they say is rife with fraud, cronyism, and even designer child trafficking.

Weigel has become an outspoken advocate for those families, naming and shaming the lawyers and judges who prey on vulnerable children and parents. And now, he charges, those very same legal elites are striking back. The CFP Board’s attorneys and investigators, Friedman and Shiffman, aren’t just random regulators, he says – they’re “outside bar card” cronies on a mission from the embattled family court cartel.

Weigel believes these bar-linked enforcers are colluding with the crooked family court lawyers he’s been exposing, using the CFP inquiry as a pretext to shut him up and discredit him.

This is payback, pure and simple.

Weigel’s not the first whistleblower to face blowback, and he knows it. He recalls how Dr. Michael Burry – who exposed Wall Street fraud in The Big Short – got “rewarded” with spurious audits. The playbook is old: when someone dares to speak truth to power, those in power aim to destroy their credibility.

But Weigel refuses to be a victim. He’s fighting back with every tool at his disposal, from social media megaphones to legal action. He’s making the CFP Board fight itself a public spectacle, inviting cameras and demanding transparency at every step.

The question now echoing from his supporters is pointed and chilling: Who do these regulators really work for? Are Friedman, Shiffman, and the CFP Board truly serving the public interest – or protecting the “pathetic excuses of fiduciaries called lawyers” that Weigel says are abusing American families?

The Certified Financial Planner Board, in Weigel’s view, has revealed its true colors. Rather than defend ethical practitioners and the public, it appears to be wielded as a weapon to silence a whistleblower and shield corrupt institutions.

In the court of public opinion, David Weigel is making his case loud and clear. He casts himself as a modern-day crusader standing tall against a crooked empire of bad actors – and judging by his growing following, many see him as just that.

“Some of us need to stand up and be men in this world,” Weigel declares, utterly unshakeable in his conviction.

He’s not intimidated by the CFP Board’s investigation; he’s inviting the fight. And if the Board thought they could quietly strip the credentials of a Top 1% manager without anyone noticing, they’ve gravely miscalculated.

David Weigel is on the warpath, defending not just his own reputation but the countless families he’s vowed to protect. In this high-stakes showdown between a fearless fiduciary and a supposedly “ethical” board, one thing is certain: Weigel won’t back down – and he’s not alone.

The real question is whether the CFP Board is prepared for the spotlight he’s trained on them, and whether it will answer the only question that matters now: Who are they really working for?